Welcome to my first ever monthly report! This is where I’ll talk about my extra income earned, progress on paying off my debt, earning rewards, and blog traffic for the month of July in this year of 2018 AD.

Let me warn you—this is going to be a lengthy post, but I will try to make it easy to navigate and read.

Contents

1. Background

Why did I even start Pilgrim for Less in the first place?

In a nutshell, I’ve been blessed with opportunities to chaperone some major pilgrimages to the March for Life in Washington, DC and the international World Youth Days in Rio De Janeiro, Brazil (2013) and Krakow, Poland (2016). Starting in 2015, I started traveling to Japan on a monthly basis for work culminating in a six-month assignment in 2017.

Sprinkled throughout those years from 2013 until now, I’ve gone on many other smaller trips.

I noticed a common thread in all my travels, regardless of intention or purpose–

Pilgrimages.

Wherever I travel, I always make an effort to visit churches and attend Mass no matter where I am in the world traveling for whatever reason. Work? Visit family? Trying to fly a lot in order maintain elite flyer status? Yes, all of the above. Most of my trips included a pilgrimage portion.

And I would share about these pilgrimages on social media.

And some people would ask me questions. And I didn’t have good answers.

Therefore, I started Pilgrim for Less as a way to chronicle the pilgrimages I go on and to help others go on more pilgrimages too.

The other half of it is the money issue. Going on trips and pilgrimages requires moolah. And I don’t have a whole lot of extra money to burn traveling the world (anymore). See my pilgrimage problem in 2018.

After surveying some friends, I saw that most people’s obstacles to going on more pilgrimages are not having enough time and money. Hence, Pilgrim for Less–more pilgrimages for less time and less money.

Why am I doing these monthly reports?

First and foremost, I’m putting into practice something I’ve learned through engineering, project management, and self-help type stuff I’ve read.

You cannot change what you can’t measure. #Metrics

These monthly reports will help me keep track of my personal progress on reducing debt, increasing income, and growing a community of pilgrims who pilgrimage for less.

Secondly, I hope you find these reports to be inspiring. Yes, I may be an engineer, but I’m not swimming in excess cash monies. I hope that through my example, despite me carrying lots of debt and loans, that it is possible to travel more. More importantly, that it is, indeed, possible to go on more pilgrimages.

Thirdly, legitness. The numbers I present to you below are real. I want to be transparent with you.

And lastly, these monthly reports are a fun way to lightheartedly take all these things seriously.

Currency Probz

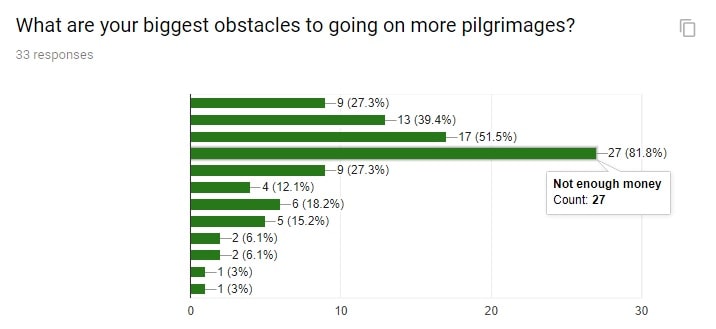

When I sent out my initial survey before I launched Pilgrim for Less, one of my questions was “what are your biggest obstacles to going on more pilgrimages?”.

“Not enough money” was the most frequent answer at 81.8% of my survey takers.

Therefore, I think a large focus of Pilgrim for Less will be on the money side of things. Primarily because you need money to pay for the logistic aspects of a pilgrimage. And for charity, too.

But did you know you don’t have to pay for travel and pilgrimages using cash?

We’ll explore the use of points and miles to pay for travel soon, but I will list my stats below.

2. Income

In this section, I am not going to talk about my actual salary. I feel like that it is best practice not to share that publicly anyway… But, we can assume that my salary is enough for 1) all expenses, 2) investments, and 3) and savings for budgeted and fun things. And with all that, I have barely any extra leftover.

Instead, I will share with you side income. In other words, this is income that I make in addition to my salary. These will include side hustles and this blog.

Also, I should mention here that part of my hope with Pilgrim for Less is for it to be a means to generate income with the goal of it being self-sustaining. Running a blog does have its own expenses, so I’ll be exploring ways to monetize it.

Amazon Seller – $0.00

At the end of 2017, I started pursuing ways to earn more money and to get a better handle on my finances. Somewhere in that, I learned how to sell things effectively on Amazon.

I gave it a try from January through February of this year, but ultimately decided that it took me too much time for too little profit on something I wasn’t able to give full attention to. Why wasn’t I able to give full attention? Uh, grad school…

However, I still have unsold inventory that sells occasionally from time to time even though I stopped actively pursuing this.

Last month, I sold a card game. It’s been the only thing I’ve sold since March or April. However, since it sold right before the end of the month of July, and Amazon pays every two weeks, I won’t be seeing the profit from that sale until the first August payout. I’ll include that payment in the next monthly review. Who knows, maybe some of my leftover yarn in inventory will also sell!

Cool.

Google Ads – $0.03

If you were browsing around Pilgrim for Less in the months of June and July, you may have noticed ads floating around the site.

I implemented them more as a proof of concept to learn how they work. Additionally, I had issues getting them set up, and I wanted to make sure I overcame those issues.

After getting some counsel from a blogger that I’ve recently come to respect a lot, I decided to stop showing ads for now. On the hard launch of Pilgrim for Less on July 25th, I turned them off.

However! In the month that I had ads running, the site made $0.03!!!

And there was much rejoicing!

The ads will remain off for now so I can focus on putting out most excellent content and drive traffic to this site.

Amazon Affiliates – $0.00

Another way to help earn money through the use of the blog is through affiliates. Basically, affiliate income is earning commission for driving sales at a website. In this case, I’m with Amazon. I also wanted to test this out as a proof of concept.

If you see me share links on posts or reviews that go to Amazon, that’s what this is about.

I made $0, but that’s okay. I haven’t really done much with Amazon products just yet.

However!

Check out my review of the small Moleskine hardback pocket notebook, and I encourage you to consider purchasing your own! They’re quite nice for travel-friendly spiritual writing and recording of prayer intentions.

Also, I recently shared two creative ways to carry on holy water on a plane. You can buy bottles conducive to that from the Amazon links on that post!

3. Debt

Whew. I feel like this is going to be an awkward section because the numbers are so much higher, and the numbers are also real. Like, this feels personal, but that’s okay. I’ll get over it. Bear with me. I will split this up into two different sections: loans and credit cards.

Loans: -$1937.15 ($165,335.16 left)

Loans are the major debts that will take me a long time to pay back.

Auto: -$296.77 ($10,514,51 left)

Back in 2016, my brother’s car at the time was on its way out. It was a crappy, used Mazda 6 that ended up needing a lot of work. He had long commutes between home, work, and school so his car wasn’t going to survive for much longer. Seeing this need, I decided to give him my 2010 Honda Civic, which had already been paid off, and since I’ve been the only owner and kept it well-maintained, I figured it would be better for him to take my car versus him putting in the time and money buying another potentially crappy used car.

Because of the extra cash flow I had from work trips to Japan, I was able to put in a very substantial down payment on a new 2016 Honda Civic. For personal finance bloggers, that’s potentially a huge sin I committed buying a new car, but then…I’m not a straight-up personal finance blogger. So there.

Since reevaluating my finances at the start of 2018, I’ve been making minimum payments on the car. Since I was able to land a low interest rate for this auto loan, I’ve been paying minimal payments and prioritizing paying more on my student loans, which have higher interest rates.

Mortgage: -$1305.01 ($149,177.84 left)

Again, I probably committed another grave personal finance sin by buying a new house. Like, it had to be built. But, I’m glad I did because it’s now worth thousands of dollars more than what I bought it for because values have rocketed since I’ve moved in.

I also make minimum payments on my 30-year mortgage because of a pretty low interest rate.

A few months ago, my mortgage company lowered my monthly payment as part of the annual adjustment, but that fluctuates up and down every so often.

Student Loans: -$335.37 ($5642.81 left)

First, a disclaimer. I’m only considering my undergrad student loans for my bachelor’s degree. My current graduate degree is paid for (or reimbursed, rather) by my company, and I won’t be counting those loans.

Ah, student loans. Honestly, I feel like I should have paid these off a long time ago. The reason why I haven’t was because of unexpected major expenses and those World Youth Day pilgrimages that cost me thousands of dollars. And then it doesn’t help that I took on another new car AND a mortgage since 2015.

But wow! Looking at what’s left just now made me realize how close I am to crushing these student loans once and for all! And I find that really motivating!

In July, I was able to pay off one of my loans!

I would show a picture with proof, but my student loan servicer hasn’t sent me any sort of fanfare stating that one of my loans has been paid off. Maybe next month?

Credit Cards: +$956.62 ($3663.21 left)

Just so you know, I have 5 credit cards:

- American Express Hilton Surpass

- Capital One Quicksilver

- Chase Freedom

- Chase Freedom Unlimited

- Chase Sapphire Reserve

I won’t get into why I have that many credit cards at this time. I also won’t break down the debt for each card since they’re all in constant flux. The balances will be different tomorrow.

But yikes.

July was a bad month for me reducing credit card debt. I added almost $1000 more in credit card balance due to some large purchases.

I fell victim to Amazon Prime Day, because I invested in some hardware to beef up security in my house.

Additionally, I’ve been looking to upgrade my iPad from the Mini 3 to the 10.5″ Pro. My iPad Mini doesn’t fit my memory needs anymore, and it’s laggy in the apps I run the most for productivity purposes. With two upcoming grad school classes, I didn’t want the frustration of using something small and old. I finally pulled the trigger also because I saw that Apple had an increased earn rate for American Airlines miles through the AAdvantage eshopping portal. It’s normally 1 mile per $1 spent at Apple, but it got increased to 5 miles per $1 spent for one day, and that’s when I purchased my refurbished iPad Pro.

Somewhere in my array of savings accounts, I have enough money stashed away to pay back most of these extra expenses. So I’m not too worried about these purchases.

And like I mentioned in Crushing My Debt, I use my credit cards to pay for everything. I use the app/website Mint for budgeting and as a dashboard that I review every few days. Additionally, all but one of my cards are set to autopay because I restructured my finances to be more automatic. I’m still tweaking and working on it, but my intended money flow is mostly there.

I think my average credit card debt from month-to-month should hover around $2400 to be “within budget” So with a total balance of over $3600, I’m way over that. Amazon Prime Day and increased rewards earning opportunities are dangerous.

Speaking of earning rewards…

4. Rewards

Rewards haven’t really been covered on Pilgrim for Less yet, but I am into collecting miles and points. Miles and points can be used to pay for travel expenses, especially for airline tickets and hotel stays.

I’m enrolled in the following programs:

- Airlines

- American Airlines AAdvantage (+570 / 91337 total miles)

- Delta Skymiles (+0 / 8110 total miles)

- United MileagePlus (+0 / 1874) (or Chase UR points are transferable)

- Singapore Airlines KrisFlyer (+0 / 0 total miles) (or Chase UR points are transferable)

- Credit Cards

- Capital One Quicksilver (+$0.86 / $8.73 total cash back)

- Chase Ultimate Rewards (+4061 / 39171 total points, combined all three Chase cards)

- Hotels

- Hilton Honors (+708; -17000 / 657639 total points)

Recall that I traveled to Japan. A LOT. From 2015-2017. And I traveled to faraway places in addition to that. That’s why I have a lot (!) of AAdvantage miles and Hilton Honors points. And also why I am currently AAdvantage Executive Platinum and Hilton Honors Diamond, respectively.

It’s actually all this frequent travel and earning of points of miles that also gave me the concept of using miles and points in order to reduce pilgrimage costs. But more on that later.

These days, my points and miles earning also correlate to my credit card spending. For example, since I use my Chase credit cards the most, you’ll see the biggest earn this month for Ultimate Rewards.

For July, I actually didn’t fly. But I still earned AAdvantage miles by shopping online (using my Chase Freedom Unlimited!). As of the time of this writing, my iPad Pro purchase isn’t reflected in my AAdvantage miles earn/total and Chase Ultimate rewards earn/total since it is still pending.

And for Hilton, I didn’t stay in any hotels in July, but I earned those 708 points from my Hilton Surpass American Express card for filling up my car with gas. I also spent some Hilton points last month in order to pay for a hotel stay on an upcoming trip.

Also, #FunFact. I earned United MileagePlus miles by flying, but not ever on United. Codeshares are fascinating.

5. Traffic

One of my goals for Pilgrim for Less is to build a community of Christian and Catholic pilgrims who go on more pilgrimages without having to spend lots of time and money. I think one way to track that is to track who all is visiting the site and who all is subscribing to email and following the social medias.

Blog Traffic

- Unique Pageviews: 283

- New Users: 108

- Sessions: 185

Email and Social Media

- Email Subscribers: 29

- Facebook Page Likes: 12

- Twitter Followers: 1 (but it’s just me…lol)

- Instagram Followers: 6

I’ve intentionally kept everything small and low key since I’ve been operating in “beta” mode, and I haven’t yet widely broadcasted about Pilgrim for Less since the official launch last week. I do have a strategy for driving more traffic and hopefully more email subscribers.

Twitter and Instagram are more like experiments, and I don’t think I’ll focus as heavily on those. And I feel like I’m better at Instagramming than Twittering. But I know Twitter is ripe for community. So we’ll see.

6. Cool Things

I wasn’t able to go on any reportable pilgrimages this month, but I was able to make progress on my “Parish Mass tour” (I guess I’ll call it that). In my blog post, Striving To Be A Locally Adventurous Pilgrim, I mentioned how I’ve made it an enduring goal to attend Mass at all 97 parishes of my diocese. That’s a lot. I started back in 2016, but Japan happened, and I couldn’t make a lot of progress.

A few weekends ago, I went to St. Benedict, which is a Latin Mass/Extraordinary Form parish in my diocese. That was pretty neat. I gave photographic evidence of that on the Instagram page.

On the side, I’ve been in talks with various people. I’m trying to line up guest posts. To be honest, I will be quite challenged in putting out more content when I return back to grad school in September, so I’m trying to line up guest blog posts to fill in my gaps.

And I’m also in talks to do collaborations with another friend who is focusing on pilgrimages as well (actually, he’s the friend that got me started on pilgrimages!). Much excite. Get hype. Stay tuned.

Lastly, my most popular post in July was… -taiko drum roll-: 3 Ways to Fly Cheap

7. Goals

I’m challenging myself to increase my email subscribers to 40 by the beginning of September. I’m confident I can do this by blowing up this blog. With traffic. I’m currently mentally outlining a strategy to do so. Of course, you can help me out by referring a friend who would be interested in learning more about going on pilgrimages for less time and money :-).

Next, I’m setting a goal of making 3 affiliate sales over the month of August. It’s not much, and I think it will be achievable. There are a small handful of items I’ve purchased on Amazon that I need to review that I think would be useful for the pilgrim or traveler so you can expect to see those posts this month.

As far as going on pilgrimages, I already have a trip out of state booked. I’m waiting to sit down and talk with a friend, who is from that location, in order to gain more insight as to different Catholic and touristy places to visit while there. Additionally, I hope to make a little more progress going to Mass at all the parishes in my diocese. Hopefully two!

I need to watch my spending in August. I shouldn’t make huge purchases, and I need to watch my grocery and restaurant spending because July was a bit too much in that regard.

And there you have it. The first monthly review.

Until next time!

JR is a full-time engineer working in the aerospace industry. Apart from having such a fly job, he flies unto the arms of Our Lady and the Church pursuing his faith and a relationship with Christ. Over the past several years, faith and flying via pilgrimages became a thing. When he’s not being fly, JR hangs out with family, friends, his chihuahua, and with thoughts of the next trip.